I’ve long said that I am not a car-collector; that word conjures up images of straw hats, silk suits, deep pockets, and mint cars stored and displayed in pristine spaces. I will admit that I do own one silk Armani sport coat, but I paid eight bucks for it at a thrift store. And the pockets are sewn shut, something I find deeply metaphorically appropriate.

Nonetheless, I do own eleven cars, a few of which are quite nice, and when I drive the pretty, shiny ones, people make certain assumptions about me. In my first book, I tell the story of skinny, shaggy 30-year-old me driving my just-painted 3.0CSi back in 1988. The sun lit up the new paint, chrome, and rubber. An older man—meaning someone who was probably ten years younger than I am now—pulled up next to me, looked admiringly at the gorgeous red BMW coupe, rolled down his window, and said “Nice car!”

“Thanks,” I replied.

Then he blurted out a question that many people might think, but most would filter out: “How does a guy like you own a car like that?”

“Drugs!” I said, and drove off.

Some of my cars, as you probably know, are more about scars and patina than beauty, but I’d be lying if I said that I didn’t enjoy the pretty ones.

When I drive the E9, people make assumptions.

While I absolutely love this stage of my life where I’m a self-employed writer whose job it appears to be is to buy stupid vehicles no one else would touch with ten-foot ten-millimeter wrench, resurrect them, and road-trip them, I earn only a fraction of the income I used to make as a full-time engineer. At the same time, the number of cars has remained in double digits.

Money-wise, it’s increasingly clear that this is a problem.

There’s no getting around the fact that being a car person ain’t cheap. Cars cost money at every stage of their—and your—mutual existence. Obviously, there’s the purchase cost: If you’re a bottom-feeder like me, you try to drive it down by buying cars in need of work, but as I’ve written, here in my great home state of Massachusetts, you get tripped up by the 6.25% sales tax that’s assessed not on what you paid, but on the car’s book value (they use the NADA “low” figure). In the 2002 waters in which I often swim, those values range from $7,700 for a ’76 2002 to $13,750 for a roundie ’72 tii, with a commensurate sales-tax bite of $481 and $859 respectively. I have to fork over this amount even if I paid peanuts for the car because it was dead, rusty, or both.

I’ve learned to shrug this off as the cost of doing business. It stings, but at least it’s a one-time sting. And at least the pain is salved by having a new toy.

In contrast, the recurrent annual expenses, which don’t carry with them any driving or performance benefit, are really starting to hurt. Yes, cars are inherently needy creatures, and you should expect to have to spend money if you’re resurrecting them or simply maintaining them in driving order, but one of the frustrating things is how they burn money even while they’re just sitting.

Right now, my single biggest static cost is garaging. The eleven vehicles consist of two daily drivers, the little Winnebago Rialta RV, and the eight vintage cars (seven BMWs and the dead Lotus) that must be kept out of the elements. I’ve got space for three cars in the garage at the house, and I shoehorn another into the warehouse of my former geophysics employer (to whom I still consult). In addition, as I’ve said, I pay $50 a month for each of four un-electrified, unheated, slightly leaky garage spaces out in Fitchburg. While that’s dirt cheap, and absolutely essential for me to do what I do, add it up and and you’ll see that it totals $2,400 a year, which to me is a non-trivial sum. And once the leaky roof is fixed, the rent is certain to increase.

The four $50-a-month spaces in Fitchburg are essential and cost-efficient, but multiply it out and it’s real money.

I’ve written that agreed-value insurance with Hagerty is the biggest single factor enabling me to keep buying inexpensive crime-of-opportunity cars. I never cease to be amazed by the fact that I used to pay about about $150 a year to fully insure my 3.0CSi with Hagerty, and can insure a just-purchased $4,000 car for maybe a third of that. But as the 3.0CSi and the two tii’s have appreciated in value, I’ve had to increase their coverage lest I take a bath if they get whacked, and with that, obviously the cost of the policy goes up.

Bertha, the Bavaria; the ’79 Euro 635CSi without its original M90 motor or dogleg tranny; and the dead Lotus aren’t insured for much, and thus still have a low individual annual insurance cost—but it adds up. The total annual cost of the Hagerty policy for all eight cars, the parts and tools at my house, plus roadside assistance, is about a thousand bucks a year. That’s a great value—I’m glad that there are some advantages to being a 60-year-old man with a flawless driving record living in a nice community—but it’s certainly a lot higher than it was when I was insuring just the 3.0CSi.

The Hagerty bill is very reasonable for what I’m covering.

Traditional insurance on each of the two daily drivers is about $600 a year. We typically have the Rialta RV on the road for about half the year, so call that $300. Total: About $1,500.

Next there’s annual registration. In Massachusetts, you pay a $60 registration fee to get a regular plate, and $80 for a vanity plate, but it’s not just a one-time fee. A regular registration has to be renewed every two years, but the vanity plate comes up for renewal annually. As much as I’ve wanted Louie to proudly wear his name on a plate, and as much as a LOTUSH plate would have me howling with laughter whenever I look at it, I’ve held the vanity-plate-line at two (WARP9, which has been on the 3.0CSi for 28 years, and KUGEL on the Chamonix tii). Adding up the annual registration costs of the ten vehicles (everything but the dead Lotus), it comes to $400/year. It trickles in, though, because the renewals are sent out on the anniversaries of the initial registrations.

I’ve been paying for the WARP9 vanity plate for a long time. It’s got two more stickers on it now. That’s a lot of vanity.

Next, each car that’s officially on the road has to undergo Massachusetts’ annual inspection: Thirty bucks times ten (again, everyone except the Lotus) comes to $300. Like the registration renewals, the inspections are staggered, so the whack doesn’t come all at once.

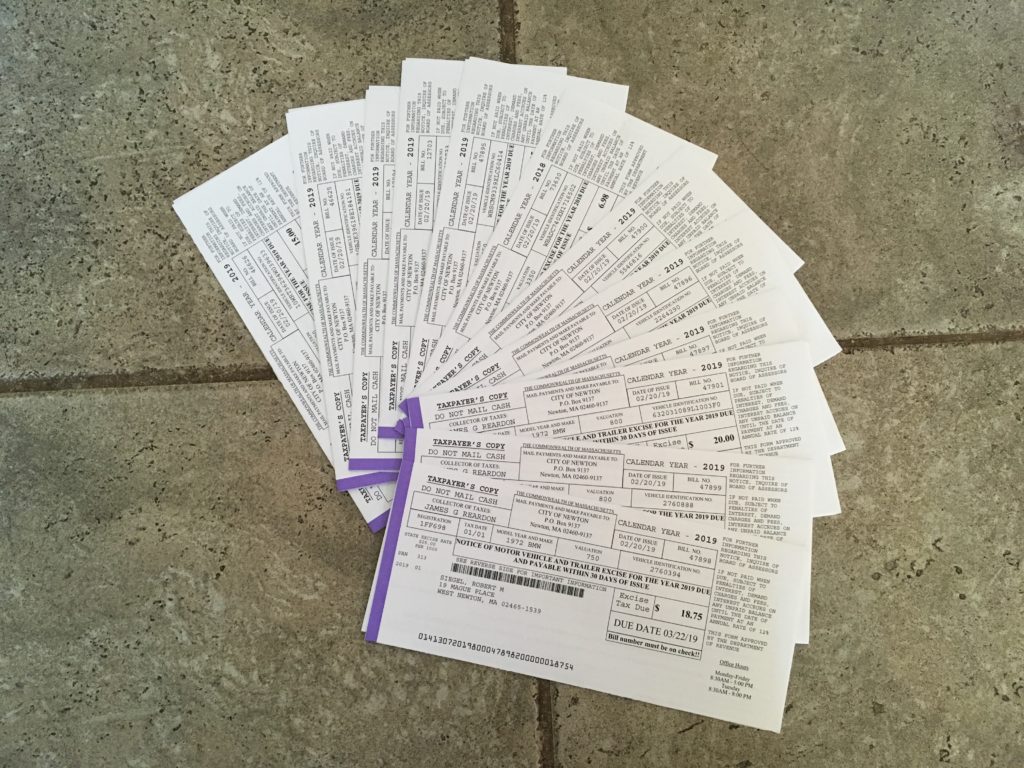

In contrast, the annual Massachusetts auto excise-tax bills, assessed by the city or town, all come in the mail at the same time. Since the city of Newton thought that I still owned the Lama, and since there’s a truck and a trailer from my old geophysics job that still have this address listed as their official residence (I did this years back so that the registration and excise renewals would come directly to me instead of falling into a bureaucratic black hole, and in a quid pro quo, handling this and inspection for them gets me one space in the warehouse plus access to the truck and trailer if I need to tow something), there were an extra-dramatic 14 envelopes.

Unlike the one-shot state sales tax that draws from a database that’s definitely aware of the cars’ current values, the annual excise taxes are fortunately on the basis of the depreciated initial cost of the car. My 2003 E39 530i Sport is, somewhat surprisingly, the most expensive by about a factor of about 2.5, at $104.50. Maire Anne’s decade-newer 2013 Honda Fit is second, at $42.50. The ’99 Z3 M coupe comes in third at $36.25. The most valuable car, the 3.0CSi, is only $28.75. The rest of the cars are about twenty bucks each. The total annual excise-tax bill I just paid came to $301.25.

It’s dramatic when all the excise tax bills arrive at once

So: $2,400 for garaging, $1,011 for vintage-car insurance, about $1,500 for standard insurance, $400 for registration, $300 for inspection, also about $300 for excise tax. Listing them like that, only the $2,400 garage cost sticks out as painful, but if you add it all up—which I’ve never done until this moment—it comes to almost six grand a year.

Ouch.

When looked at in this way, the number strikes me as high enough to be not just problematic, but unsupportable—a clear flashing red light that I’m living beyond my means.

Where do we go from here? Well, I’ll do what any enthusiast would do, which is to engage in denial and try to look at it a different way. Taking the two daily drivers and the RV out of the picture (both Maire Anne and I do need to drive, we both really enjoy our three-day trips to the beach in the RV, and it’s a cheap vacation) and looking only at the eight vintage cars on the Hagerty policy, the annual total is $4,087.

That’s better, but still a barely defensible number. Let’s try it another way.

Breaking it down for each of the eight vintage cars, it’s $511. Okay: five hundred bucks in fixed annual costs to own each car. That’s not only seems reasonable, it’s a great way to wrap my head around the problem AND stay in denial, because selling one of them would only move the needle by about five hundred bucks annually, and there’s no way I’m going to sell all eight of them. Problem solved! I feel so much better! (Seriously, the number probably will ratchet down slightly in the next few months.)

Of course, these expenses are not, in fact, the cost of doing business. They’re the cost of satisfying passion. And to me, that’s not really about shiny paint. I look forward to the arrival of spring when I can be driving Bertha again and wailing on the Webers. I sincerely hope that when I’m at a stop light, sitting in the ripped Recaros, looking out over the dinner-plate-size rust blisters on her hood and smiling like an idiot, someone rolls down his window and says, “How come a guy like you drives a piece of crap car like that?”

I’ll say, “Scars,” and drive off.—Rob Siegel

Rob’s new book, Just Needs a Recharge: The Hack MechanicTM Guide to Vintage Air Conditioning, is available here on Amazon. His previous book Ran When Parked is available here. Or you can order personally inscribed copies of all of his books through Rob’s website: www.robsiegel.com.