[30 years ago, BMW CCA’s Roundel magazine featured the story “Back to the Future.” Reprinted from the June 1992 BMW CCA Roundel magazine, all rights reserved.]

Back to the Future

By Ken Gross

In 1986, BMW sold nearly 97,000 cars in the United States. Reduced to half that number today, BMW is determined not to be muscled aside by clever Japanese imitators. With a new advertising approach that evokes the past, they’re making a dramatic comeback.

Following a disastrous 1991, BMW’s sales eased upward as 1992 began. Credit much of that rebound to the hot new 3 Series. Not only does the muscularly compact 3’er reestablish benchmark standards for small sport sedans, BMW North America wisely convinced their bosses in Munich to keep prices well below the sensitive $30,000 threshold. With Montvale’s US sales running at just over one-half those of 1986 (the peak year when BMW NA sold 96,759 units here), it’s a smart strategy.

Like rival European importers, BMW used to be quite content to let the dollar chase the Deutschrnark whenever the exchange ratio dipped. Prices kept escalating. Sticker shock notwithstanding, BMW had become the darling of the Yuppies, sharing that dubious distinction with Rolex watches, Gucci loafers and Tiffany tennis bracelets. Relentlessly quick to catch on, Japanese competitors responded with a talented quintet of “wanna-be-MW’s,” (Acura Legend, Lexus ES300, Mitsubishi Diamante, Mazda 929, and lnfiniti J30). To BMW’s chagrin, these unabashed copycat sedans were sized within millimeters of a 5 Series, but most of them have variations priced closer to a 325i.

Stung by the luxury tax, forced to offer a devastating $10,000 rebate on 750iL’s, and enjoying precious few takers for its pricey 850i, BMW has had to radically redefine its US marketing strategy. Fortunately, the 3 Series update was perfectly timed. Despite glowing “news report advertising,” datelined Detroit, from someone called Karl Treutler, Audi is still struggling just to get on customer shopping lists. Mercedes-Benz remains two years away (in the US market) from an all-new 190E. Among the three German high end importers, BMW is in the catbird seat.

But the Stuttgarters haven’t been napping. With its very capable 400E, Mercedes-Benz beat the Bavarians to a true, V-8-powered Lexus-fighter, and M-B’s outrageous 322-bhp, SL-based 500E sport sedan runs rings around the aging M5 in everything except sticker price. As good as BMW’s inline sixes are, they’re no longer the mid-sized class powerplant of choice. Remember, all the Japanese 5-er-sized ‘wanna-be’s’ pack multi-cam V-6’s; bigger Japanese luxo-imitators run powerful V-8’s.

Thankfully, everything’s up-to-date in Munich City. Reheating the ongoing rivalry that competitively drives the German car industry, BMW displayed a brace of powerful new V-8-engined 7’s at the Geneva Automobile Show. If they’re smart, they’ll stuff these engines into everything they’ve got. Aside from a welcome power increase, the slick new eights will offer a timely price advantage in the 7 Series, (compensating for the faltering, and expensive, 750iL V-12) while sacrificing very little performance.

And think about this: Packing one of those new 4.0-liter V-8’s, a 540i could become a 400E-eating “pocket battle ship.” Hints a BMW NA insider: “I’ve driven one already; we couldn’t be BMW without a 540i.”

But realistically, that’s not where the main battle is being fought. Thanks to its 3 Series coupes and sedans, and a soon- to-come new 3’er convertible, BMW retains a powerful presence in the “low-end” luxury lineup. But Acura sold more Legends in January than BMW NA sold cars in its entire lineup. And while it’s too early to judge Diamante, ES300, 929 and J30, one thing is certain, it’s becoming a very crowded field.

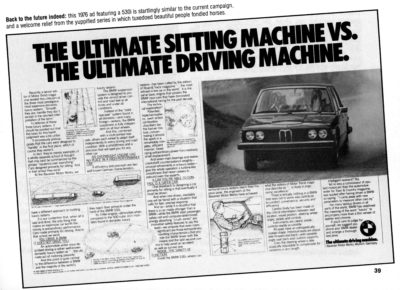

Back to the future indeed: this 1976 ad featuring a 530i is startlingly similar to the current campaign and a welcome relief from the yuppified series in which tuxedoed beautiful people fondled horses.

Even more importantly, despite the addition of fourteen new competitive models, the luxury performance sedan class shrunk to 1.0 million units in 1991, down from 1.4 million cars annually in the rollicking mid-1980s. It doesn’t take a marketing genius to realize that something’s got to give here. That’s why you see Acura, Audi, and ES300 ads touting lease prices below $399/month. Price has become the chief differentiator. Even Mercedes’ 190 ads proclaim: “$29,850: So affordable (sic), anything else could be fiscally irresponsible.”

We just drove a lovely 525i from New York to Washington DC and back—in a blinding rainstorm. It was sure-footed, allowing us to motor merrily through the deluge at point gathering speed. Of course it was luxurious and, most importantly, the 5-er felt rock solid in that Teutonic all-of-a piece way that the Japanese auto makers haven’t been able to equal.

But the 525i’s Mulroney sticker, after adding a leather seating package, additional wood trim (that unfortunately looked rather plastic-y), a limited-slip diff, an on-board computer and heated seats, still totaled $39,300. These days, that’s on the high side when you’re competing in a class which includes several similarly-sized sedans from Japan—for considerably less. Looking at it another way, that sum gives ”America-firsters” a loaded, supercharged Buick Park Avenue Ultra (don’t snicker, this is a surprisingly capable, if a bit relaxed, mile-eater) or a much-acclaimed Seville STS to consider—with change to spare.

It’s all too easy to suggest that BMW simply should lower its prices and compete head to head with what are now being called the “near-luxury” Japanese contenders. But that’s neither feasible nor realistic. Although cost reduction plans are in progress, Munich’s labor costs remain higher than those of Japanese manufacturers. One reason is that German workers enjoy more benefits, holidays and perks than their Japanese counterparts.

More to the point, building a BMW is considerably more labor intensive than building a Japanese competitor, although this is changing, thanks to ‘engineering for production’ techniques. BMW’s designs have been traditionally more complex and with 550,000-600,000 cars annually, they don’t have the unit volume cost advantages enjoyed by larger manufacturers. Lastly, some of BMW’s many built-in passive and active safety features are simply more expensive.

BMW’s chief engineer, Wolfgang Reitzle, likes to say that its cars are built to a loftier performance standard. He cites high speed autobahn requirements as proof, wryly suggesting that many Japanese competitors lack the oversized brakes and rugged suspensions needed for sustained autobahn use. Whether Reitzle’s right or not, that particular point is less applicable to driving on American highways where 55-65 mph is the rule, 65-80 mph is the norm, and three-figure speeds will get you a free room in the local “Gray-bar” motel.

Facing what seem like overwhelming odds, what’s BMW to do?

When many of the hardest marketing case studies are autopsied, time after time, it’s clear that successful companies who’ve fallen from grace usually did so because they forgot who they were. BMW NA readily admits their cars are not for everyone, but BMW’s traditional “driver’s car” values still touch a responsive chord for a surprisingly large audience.

With competition in the performance luxury class intensifying, and their own sales sliding precipitously downward, it was time for BMW NA to analyze not only its message, but to better explain the fundamental reasons why someone should pay a little extra to purchase a BMW.

You’ve been seeing the results in recent magazine ads and on television. With its recent extensive repositioning, BMW’s gone well beyond “the ultimate driving machine,” with long copy advertising that hammers home exactly who they are and what they’re selling.

“We could build an automobile with an even smoother ride, but that would make us uncomfortable,” reads a recent advertisement. “If you completely insulate the driver from the realities of the road, you’ve removed his abilities to safely contend with the realities of driving,” reads another. Or “We can’t prove that BMW owners are better drivers, but if they believe it, [and the ad shows eight enthusiastic Bimmer owners of all ages] maybe there’s a reason.”

There’s definitely something very different implied here. BMW’s speaking out about the very qualities that enthusiasts have long criticized about Japanese cars – that they’re too quiet, too numb, too insensitive, even too much alike. At the same time, BMW NA has held pricing steady, ensuring with the 3 Series, for example, that despite countless improvements, the new car is competitively below the $30,000 mark.

To get the inside story, we talked to Carl Flesher, BMW NA’s canny Vice-President of Marketing. Flesher says that NA’s latest campaign “represents a big departure,” adding that “it results from intense work last summer by ourselves and our [advertising] agency, Ammirati & Puris.” Here’s how they did it:

“We analyzed the luxury market,” Flesher explains, “and we were very worried about what was happening,” he said. ”As we saw it, luxury cars were becoming commodities; their makers were advertising dozens of new features—air-bags, ABS, etc., at increasingly lower prices. We knew we couldn’t price our car to be directly competitive; we could never win a price war. BMW is not a feature car, we build driving machines.

“So we looked back at our heritage—at those elements that made us successful,” Flesher continued. “Back when BMW began its renaissance, the competition were big, lumbering cars. We sold nimble, agile, performance sedans that offered luxury and practicality—and we found a lot of new buyers. That strategy worked well for BMW until the late 1980s.

“Then there were big changes. There was the fall of the Savings & Loans; there were new tax laws (affecting company and lease car deductions), and finally there was the luxury tax. At the same time, the overall performance luxury car category shrunk. Now there are fourteen new models from the Japanese, offering every possible feature. We’re locked into an astounding share battle, but we can’t and won’t play the feature for feature game.

“We had to look for a quality that would differentiate BMW from the competition,” Flesher continues. “We decided [and Roundel readers will be delighted] that it was performance—performance in a very simple sense: acceleration, braking, cornering, evenness in handling. But that was just the beginning.”

As Carl Flesher sees it: “Consumers are much more rational today. People have adopted different values. We had to find a new language to speak to them.

“We spent ninety days analyzing the competition. What the competition were all saying was, ‘we have the better car.’ And each of them was saying it was because of all those features: airbags, four-cam V-6’s, ABS, leather, etc.

“So what were we supposed to do? Jump in and talk about our double pivot suspension? No. We had go beyond the features themselves and talk about who we were.

“You know,” Flesher pauses, “the Japanese approach to cars is exactly the same way they attack every market. They create commodities of everything: cars, cameras, TV’s, stereos … even motorcycles. Then they use intense price competition to buy market share, driving out everything in their path. Let’s face it, it’s worked for them. Lexus’ (and even Infiniti’s) overnight success showed that the traditional values long expressed by Jaguar, Mercedes, and BMW were no longer strongly differentiated enough. The new makes were able to establish themselves more quickly than anyone imagined.”

Flesher insists those sales results didn’t come as a surprise.

“Our studies also showed that people’s basic values were changing,” he adds. “Issues that had become out of control in the 1980s were settling down. Now, people were concerned with the environment, with savings, with schools … they wanted to get back in control, to make their lives easier. They were less concerned with gathering up toys.

“So we asked ourselves: why do you buy an expensive tennis racket or a set of golf clubs? Do you do it for the technology, or because you think they’re going to make you a better player? We translated that to buying a BMW, in order to find the value behind the features. And we decided that a BMW’s value was its feedback to its driver.

“We took that idea to the next logical step:

“In a BMW, the car’s precision and accuracy will make you a better driver, a driver who is alert, secure and in control—quite the opposite of all the cocoon-like ‘commodity’ competition. We think that ‘the relentless pursuit of perfection’ (to use Lexus as an example) is becoming the relentless pursuit of isolation. Lexus ads talk about the way external noise is virtually eliminated. They’re building isolation chambers. It’s the ‘ultimate driving machine’ versus ‘the ultimate isolation machine.’

“At BMW,” says Flesher, “we don’t believe in isolation. We don’t build numb cars. So we devised a new campaign to express this. When we took the results to our dealers,” Flesher says enthusiastically, “they were rejuvenated. They said we’d found the hook. They’re beginning to sell Sevens against LS400’s. Now, BMW sales people can discuss design and engineering philosophy, not just features.”

BMW NA is spending $25 million this year (a big portion of their $80 million annual budget) to launch an all-new advertising program explaining that BMWs are designed from the outset to improve a driver’s abilities—the way the best sports equipment can improve your athletic performance.

“Customers are walking into showrooms with those ads in their hands,” enthuses Flesher. “Sure, we’d like to have a larger budget, but we measure our ad quality according to impressions; our research shows this BMW advertising is well remembered.”

To this end, BMW NA is reestablishing the BMW brand as “the authority on expert driving.” They’ll back up the advertising and dealer point-of-purchase efforts with increased emphasis on the Skip Barber driving program. Interestingly, the basic direction actually stems from a marketing approach BMW first took back in 1975.

As Carl Flesher tells it: “when we looked at our old advertising, we actually found a 1975 ad with the headline: ‘the ultimate driving machine vs. the ultimate sitting machine.’ ”

BMW has gone back to basics, perhaps just in time. A recent Honda Prelude ad (Motor Trend, April, 1992) states, perhaps uncharacteristically: “That incredible sensation you’re feeling is the road.” But driveability may be a hard sell for a model many people still call ‘the Quaalude.’

A recent Lexus double-page spread (Auto Week, March 9, 1992) headlined: “Maybe It’s Time You Injected Some Monotony In Your Life” actually refers to the ES300’s automatic climate control system, but at first glance, it hints that the ES300 sedan may be monotonous, as well.

While he’s candid about BMW’s challenges, Carl Flesher doesn’t downgrade Japanese competition. “They build very good cars,” he admits, “and they’re giving many Americans exactly what they want. But our dealer feedback, especially from dealers who are dueled with Lexus, is that their customers complain about that feeling of isolation.”

BMW has been criticized for its dealers. Not long ago, BMW dealers ranked poorly in a major survey. According to Carl Flesher, that’s changing. “We’ve made incredible strides with our dealers,” he says. They know they have to change, and we’re supporting them. We’ve reduced our field organization from seven to four regions; we’ve put more people in the field, and we’ve got new policies in parts and sales.

“Our BMW area managers are like business consultants now,” he continues. “They can see more people because we’re dealing with smaller groups. We have a lot of new service programs. And we’re giving our sales people the arguments they need so they can operate effectively on the showroom floor.”

Carl Flesher is optimistic yet realistic about BMW’s situation. “Remember,” he says, “BMW is a German company, but we have an international point of view. We are fiercely independent yet we sell 550,000-600,000 cars each year, perhaps one percent of the overall market, without help from any partner. We know that some premium is acceptable on our cars vs. the Japanese, but we also know there are limits. We don’t have the same goals as the mass producers. The premium that people have to pay [to buy a BMW] is what we are all about.”

When questioned how big BMW NA wants to be in the US, Carl Flesher doesn’t hesitate. “We’d like to get back to 75,000-80,000 units,” is his answer, “with 50-55 percent of that volume, perhaps even 60 percent (if you count convertibles) in the 3 Series.”

I think BMW’s on the right track. They’ve gone back to their roots in the nick of time, and very importantly, they’re not neglecting a key link in the marketing chain—dealers and salespeople. (Carl Flesher admits NA’s dealer program is still in its initial stages. “But I think it’s so important,” he confides, “I’ve been having dreams about it.”)

Credit Ammirati & Puris, too, for a rejuvenated advertising effort. Curiously, Mercedes-Benz left McCaffery & McCall, its ad agency of thirteen years (and retained Scali, McCabe Sloves, the agency linked with the Volvo ‘monster truck debacle’). And struggling Jaguar has put its advertising account up for review. Wisely, BMW has resisted changing horses in mid-stream. Their new advertising underscores this was a correct decision. Says Flesher: “We feel strongly about our long relationship [since 1975] with A&P—and they are very proud of BMW. They give a damn about us and it shows.”

If the recession recedes at last, and there are rumblings that this may happen, BMW seems nicely positioned for a comeback. But for many Roundel readers, this re-launch simply reaffirms what they’ve known and loved all along about the spirited cars from Bavaria.

——–

Roundel Contributor Ken Gross edits Automobile Magazine’s “Vintage Stuff” section. He’s also Playboy’s Automotive Editor. Ken writes “Strictly Business,” a widely-read column in Automotive

Industries. He’s currently completing the Second Edition of the Illustrated BMW Buyer’s Guide, to be published by Motorbooks International, in Spring, 1993.